Accessibility Options

General

General Products

Simple & Transparent! Policies that match all your insurance needs.

37K+ Reviews

7K+ Reviews

Scan to download

Life

Life Products

Digit Life is here! To help you save & secure your loved ones' future in the most simplified way.

37K+ Reviews

7K+ Reviews

Scan to download

Claims

Claims

We'll be there! Whenever and however you'll need us.

37K+ Reviews

7K+ Reviews

Scan to download

Resources

Resources

All the more reasons to feel the Digit simplicity in your life!

Tools & Calculators

Tools & Calculators

37K+ Reviews

7K+ Reviews

Scan to download

37K+ Reviews

7K+ Reviews

Select Preferred Language

Our WhatsApp number cannot be used for calls. This is a chat only number.

Enter your Mobile Number to get Download Link on WhatsApp.

You can also Scan this QR Code and Download the App.

Do the Digit Insurance

Trusted by 7 Crore+ Indians

This product belongs to Digit General Insurance.

This product belongs to Digit Life Insurance.

Great Choice! Drop us your details

Super! Our experts will soon call you.

Meanwhile you can check out our benefits of porting your policy to Digit

Sorry!

We are facing some issue in processing your request.

{{abs.isPartnerAvailable ? 'We require some time to check & resolve the issue. If customers policy is expiring soon, please proceed with other insurers to issue the policy.' : 'We require some time to check & resolve the issue.'}}

We wouldn't want to lose a customer but in case your policy is expiring soon, please consider exploring other insurers.

This product belongs to Digit General Insurance.

This product belongs to

Digit General Insurance.

This product belongs to Digit General Insurance.

This product belongs to Digit

General Insurance.

Add Mobile Number

This product belongs to Digit General Insurance.

This product belongs

to Digit General Insurance.

- {{ duration }}

This product belongs to Digit

General Insurance.

This product belongs to Digit

General Insurance.

- {{ income }}

This product belongs to Digit

Life Insurance.

- {{ income }}

This product belongs to Digit

Life Insurance.

Do the Digit Insurance

This product belongs to Digit General Insurance

- I/We, hereby declare that the statements and particulars given in this Proposal form are complete, true and accurate and I/We agree that the Insurance company will not be liable under the insurance contract if it is found that any of my/our statements or particulars or declarations in this proposal form or other documents are incorrect /misleading /Fraudulent in any respect on any matter to the grant of a cover or submission of claim in future.

- I declare that the premium paid under this transaction to Go Digit General Insurance Limited is being paid by me i.e. the proposer/policyholder through a bank account or a Credit/Debit Card or a Prepaid Payment Instrument or a UPI wallet (Wallet), held by me in my name as a primary holder (referred to as “source accountâ€). I confirm that it is not a third party payment made by any other person on my behalf. I understand that in the event of a policy cancellation,the refund of premium as per policy terms and conditions may be credited back to such source account and such electronic transfer will constitute full and final discharge of the Company’s obligation.

- I/We declare that the rate of NCB claimed by me/us is correct and that no claim as arisen in the expiring policy period (copy of the policy enclosed). I/We further undertake that if this declaration is found to be incorrect, all benefits under the policy in respect of Section I of the Policy will stand forfeited.

- I hereby affirmatively warrant that the Assured named herein/owner of the vehicle insured holds a valid Pollution Under Control (PUC) Certificate on the date of commencement of the Policy and the same has been shown to the agent/authorized person of intermediary. I further undertake to renew and maintain a valid and effective PUC Certificate during the duration of the Policy period. If the PUC certificate is not found valid on the date of loss, I understand that the Company reserves the right to cancel the policy.

- I/We, hereby agree that in Case of Break in Insurance, the policy would be issued subject to acceptance of risk after evaluation of the Vehicle Inspection report. Own Damage cover (Section – I) would not commence unless the satisfactory Vehicle Inspection report has been received by us. If the Company does not receive the Vehicle Inspection report or the report is adverse, the Company, at its discretion, will cancel Policy as per the Motor Tariff.

- I/We further declare that l/we will notify in writing any change in the details so furnished hereinabove occurring after the proposal has been submitted but before communication of the risk acceptance by the Company.

- I/We authorize the Company to share information pertaining to my proposal including medical records for the sole purpose of proposal underwriting and/or claims settlement and with any Governmental and/or Regulatory authority.

- By submitting your contact number and email ID, you authorize Go Digit General Insurance (Digit Insurance) to call, send SMS, messages over internet-based messaging application like WhatsApp and email and offer you information and services for the product(s) you have opted for as well as other products/services offered by Digit Insurance. Please note that such authorization will be over and above any registration of the contact number on TRAI’s NDNC registry.

- This policy has been issued based on your declaration of Gross Annual Income and that Base Sum Insured chosen is not more than 10 times of such Gross Annual Income. In the event the declaration is found to be incorrect/wrong and/or non-submission of income proof to justify this declaration, it may result in inadmissibility of claim and/or cancellation of policy.

- I confirm that the Gross Annual Income of the family in this proposal is true and correct and undertake to submit relevant income proof(s) in the event of claim in this regard.

- This is to confirm that the Insured member(s) under this Policy does not work in Nuclear power plants, underground mines, explosives, hazardous material (e.g., fertilizers, asbestos fibre, toxic gases, toxic chemicals, pesticides etc)

- This is to confirm that the Insured member(s) under this Policy does not work in underground mines, in explosive magazines or in electrical installations with high tension supply, or insured is a jockey, circus personnel, engaged in racing on wheels or horseback, big game hunting, mountaineering, winter sports, skiing, ice hockey, river rafting, polo, or in similar activity or occupation

Terms and conditions

Terms and conditions

What Would you like to Protect Today?

Motor Insurance

Health Insurance

Super Top-up

Super Top-up

Port Health Policy

Port Health Policy

Business Insurance

D&O Insurance

D&O Insurance

Erection All Risk Insurance

Erection All Risk Insurance

Contractors All Risk

Contractors All Risk

Workmen Compensation

Workmen Compensation

Marine Cargo Insurance

Marine Cargo Insurance

CPM Insurance

CPM Insurance

Travel & Property

Popular Features you can Try!

Popular Features you can Try!

Why Choose Us?

Why Choose Us?

Super-Simple Claims

Smart phone enabled Self Inspection done in minutes!

Simple Documents

We are trusted by 7 Crore+ customers.

Totally Paperless

Digital and real-time processes with zero paper work

That's it, That's Digit

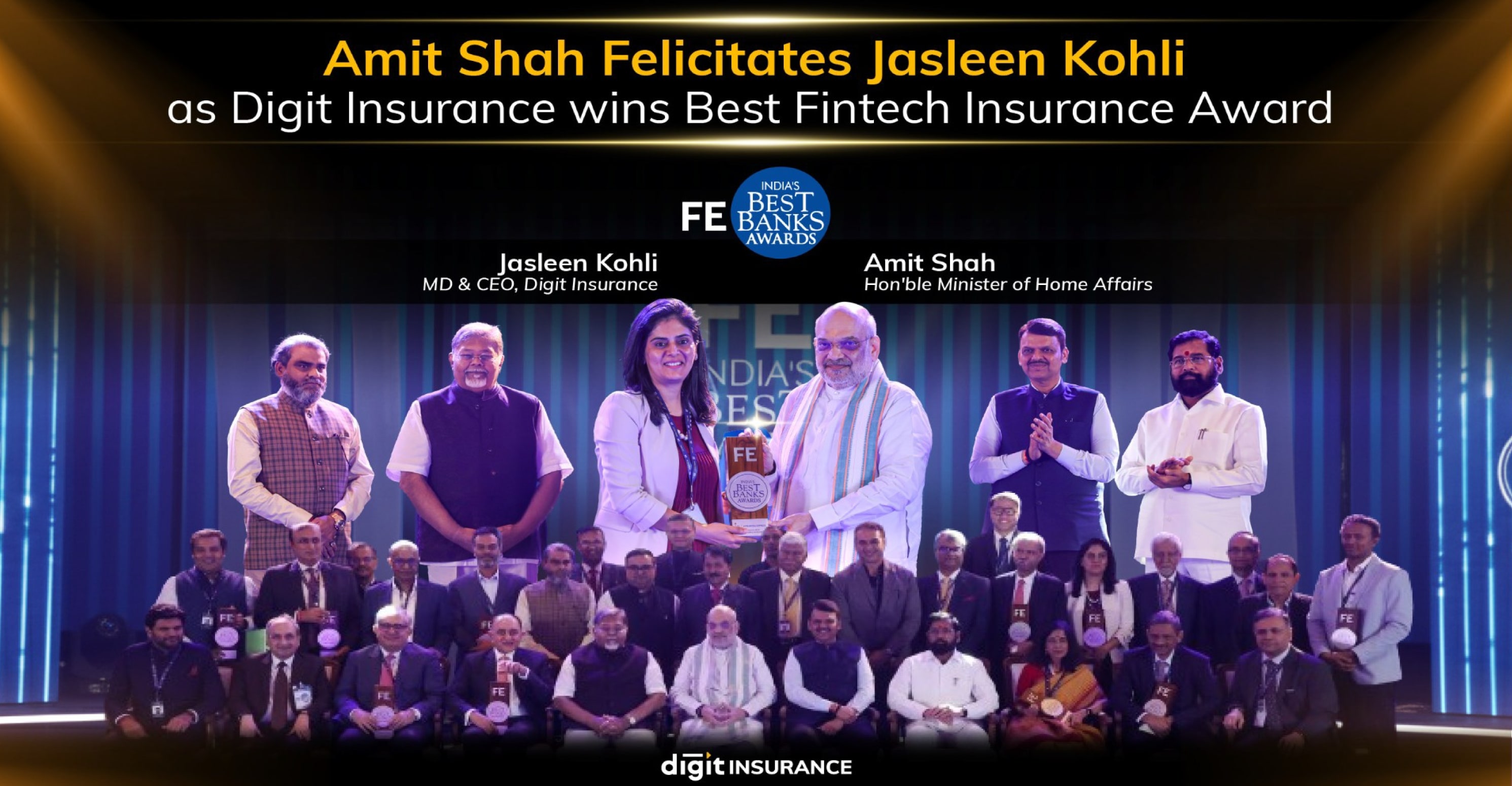

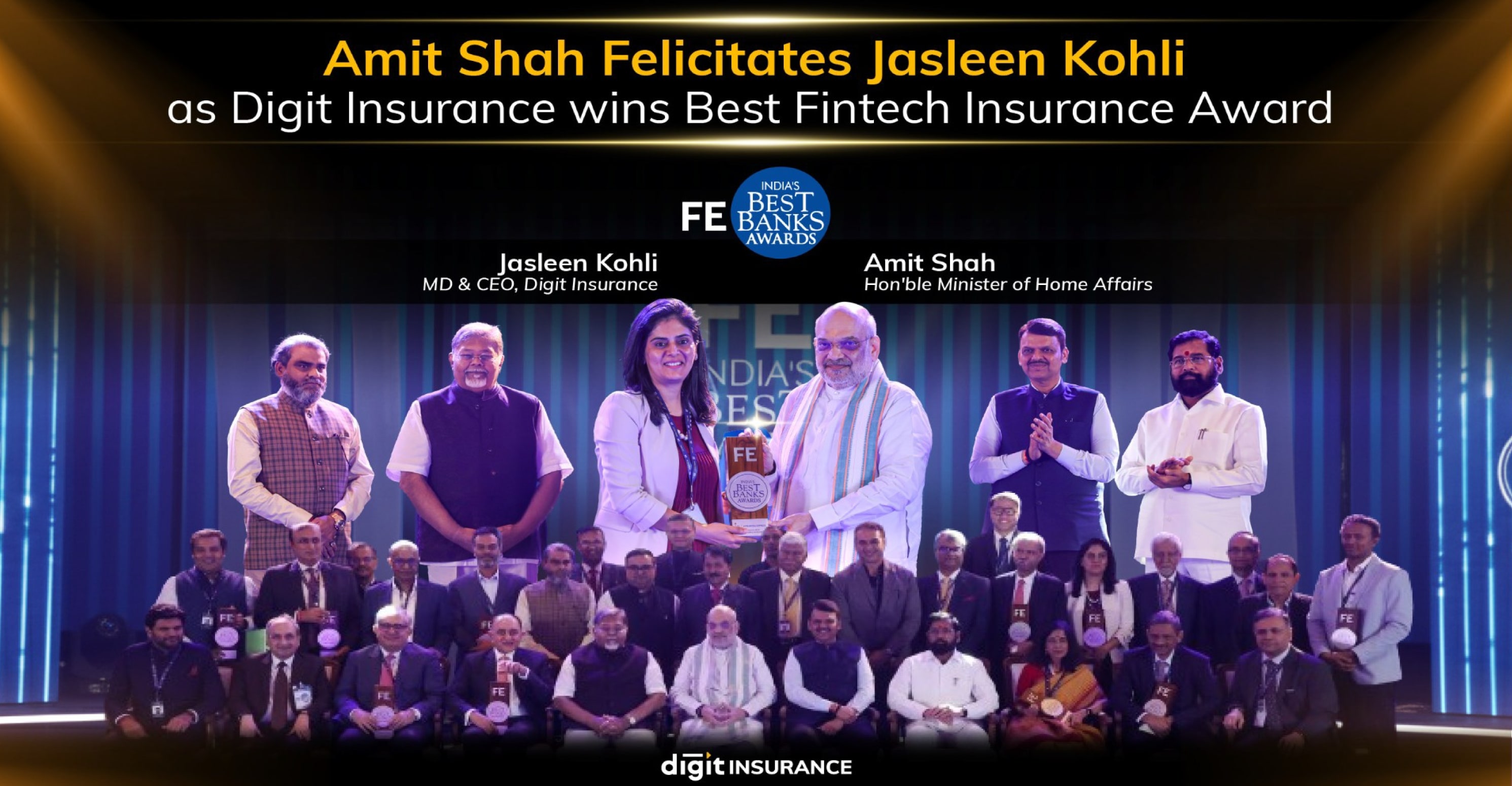

Digit Insurance awarded Best Fintech Insurance Company | Financial Express Best Banks Awards 2025

"Drive Less Pay Less" Digit Car Insurance with Pay as You Drive

Does your Insurance Cover the Essentials, Battery, Motor, Charger?

Digit has Paid its Customer 2000 Crores for Car Insurance Claims

Digit Health Insurance with Infinite Cumulative Bonus

"NO LAST MINUTES SHOCKS" Digit Health Insurance with Consumables Cover

"NOT JUST AN INSURANCE APP" Buy Insurance, Track Claims and Other Features in Digit App

Become a Partner with Digit Insurance and Grow your Business!

What Our Customers Have to Say about Us

Exclusive Features on Digit App

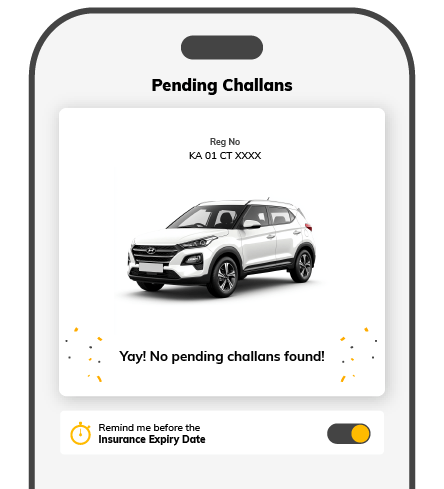

Check Pending Challans

Only on Digit App

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

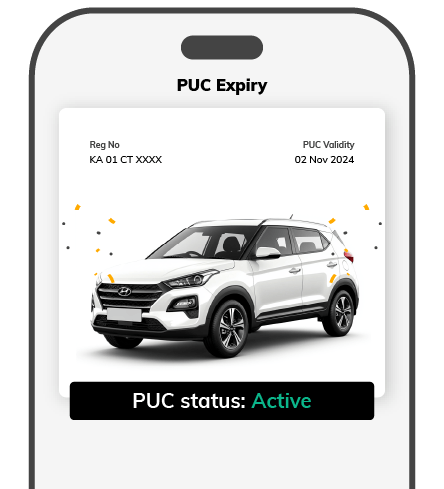

Check Vehicle PUC Expiry

Only on Digit App!

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

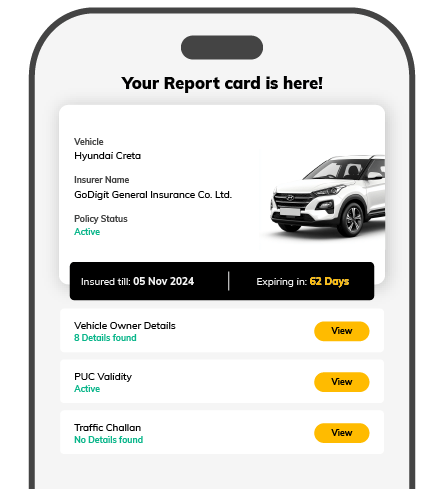

Get your Vehicle Report Card

Generate on the Digit App Today!

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

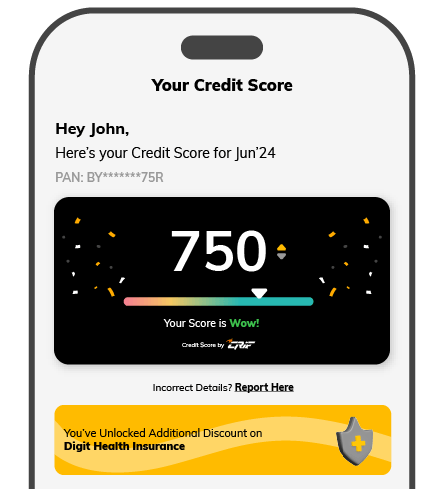

Check Credit Score for FREE

Only on Digit App!

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

4.8

Rated App

81K+ Reviews

4.2

Rated App

18K+ Reviews

Claim Filing & Status Tracking made Simple through Digit App

File a Health Claim in Simple Steps thorugh Digit App

Track Digit Health Claim Status through Digit App

File a Motor Claim through Digit App in Simple Steps

Track the Motor Claim Status through Digit App

Download Your Policy Document Instantly. Anytime, Anywhere.

Complimentary Wellness Benefits with Digit Insurance

Complimentary Wellness Benefits with Digit Insurance

Wellness Benefits

12+ Wellness Partners Offering Valuable Benefits

Digit in the News

Digit in the News

true

false

Our Transparency Reports

Our Transparency Reports

Read all ReportsBecome a Digit POSP Today

Become a Digit POSP Today

80000+ Partners have joined Digit

Earned 5900+ Crores

User friendly Agent Portal

35000+ Partners have joined Digit

Become Agent TodayTools & Calculators to Simplify Your Life!

Financial Calculators

Tax-related Calculators

Investment Calculators

Health and Fitness Calculators

Retirement Planning Calculators

Bima Bharosa (Earlier Known As IGMS)

"The best step you can take to protecting personal information- is commit to sharing information only when required."

All transactions (financial and non-financial) need to be done through our Website / Digit App / branch offices / Customer Center or you may also connect with our authorized Agents / POSPs / Insurance intermediaries.

Disclaimers

- For policies with a risk commencement date on or after October 1, 2024, all servicing activities, including without limitation claims processing and grievance redressal, shall be in compliance with the provisions of the IRDAI (Insurance Products) Regulations, 2024 dated March 20, 2024 and IRDAI (Protection of Policyholders’ Interests, Operations and Allied Matters of Insurers) Regulations, 2024 dated March 22, 2024 read with relevant Master Circulars.

- ^The discount mentioned of up to 90% can be availed with Digit Private Car Pay As You Drive Add-on (UIN: IRDAN158RP005V01201718/A009V01202223) can be purchased along with Digit Private Car Policy (UIN: IRDAN158RP005V01201718) | T&C apply*

- *The above-mentioned total partner count includes Individual Agents, POSPs, Corporate Agents, Brokers, Web Aggregators, Motor Insurance Service Providers, Insurance Marketing Firms, and Common Service Centres associated with Digit since its inception until 31st March 2025.

- *The partner commission count indicates the total amount of Rs 5,900 crores paid toward commission to all the above-mentioned partners since inception till 31st March 2025.

- *Becoming a partner with Digit is appointment as Individual Agents, POSPs, Corporate Agents, Brokers, Web Aggregators, Motor Insurance Service Providers, Insurance Marketing Firms, Common Service Centres, and is subject to fulfilment of applicable regulations read with the company's policies.

- Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers - IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

- For more details on risk factors, terms and conditions, please read policy wordings available under download section carefully before concluding a sale.

- Claim Settlement Ratio is count of (Claims paid + Claims Closed) / (Claims O/S at Start + Claims Reported - Claims O/S at End)

Renew & Download Policy Document, Check Challan, Credit Score, PUC & more

Anytime, Anywhere. Only on Digit App!

Rated App

Rated App

Scan to Download

IRDA Licensed General Insurance Company in India - Reg Number 158