Check Credit Score for FREE

Instant in 2 Mins. No Impact on Credit Score

What is Deffered Tax: Assets & Liability, Definition with Examples

A company’s financial statement indicates its growth potential, cash flow and fiscal health. Deferred tax is a crucial factor that is scrutinized in financial statements. A Deferred Tax Asset or Liability is created when there is any temporary difference in actual income tax and books of accounts (as per IFRS/GAAP).

Deferred Tax Assets and Deferred Tax Liabilities are adjusted in a company’s book of accounts at the end of a financial year. As a result, these factors impact the income tax outgo of the enterprise.

Keep reading to understand deferred tax and its impacts.

What Is Deferred Tax?

A deferred tax is an essential part of a company’s balance sheet.

Deferred tax usually has a positive or negative impact on the balance sheet. This entry in the balance sheet can be in the form of an asset or a liability. In case one has paid advance taxes and has received a tax credit which can be used in the future, it will fall under assets. Alternatively, when a business is liable to pay additional taxes in the future, it will be considered as a liability.

The difference in deferred assets and liabilities occurs when there is a timing difference.

This indicates that there is a gap between taxable income and book income. This can leave a temporary or permanent impact on the company’s future.

Let’s look at the Deferred Tax Asset meaning to understand the concept better.

What Is a Deferred Tax Asset?

Deferred tax asset indicates that a company has items or financial backup for future needs. The balance sheet indicates that the company has paid the liable tax in advance or there is an overpayment.

Individuals can receive reimbursement for the excess amount paid. Ideally, a company can have deferred assets when there are changes in taxation rules.

For instance, the introduction of tax exemptions during the yearly Union Budget. It can also transpire when a company has suffered a loss over the financial years. Then, the assets can be used to balance the losses incurred.

Factors that can lead to deferred tax asset generation are-

When one levies a tax on revenue beforehand.

Expenses are already taken into account by the taxing authority.

Tax rules difference between assets and liabilities.

Apart from learning what is a Deferred Tax Asset, individuals should also check the meaning of Deferred Tax Liability. This will help understand the difference better.

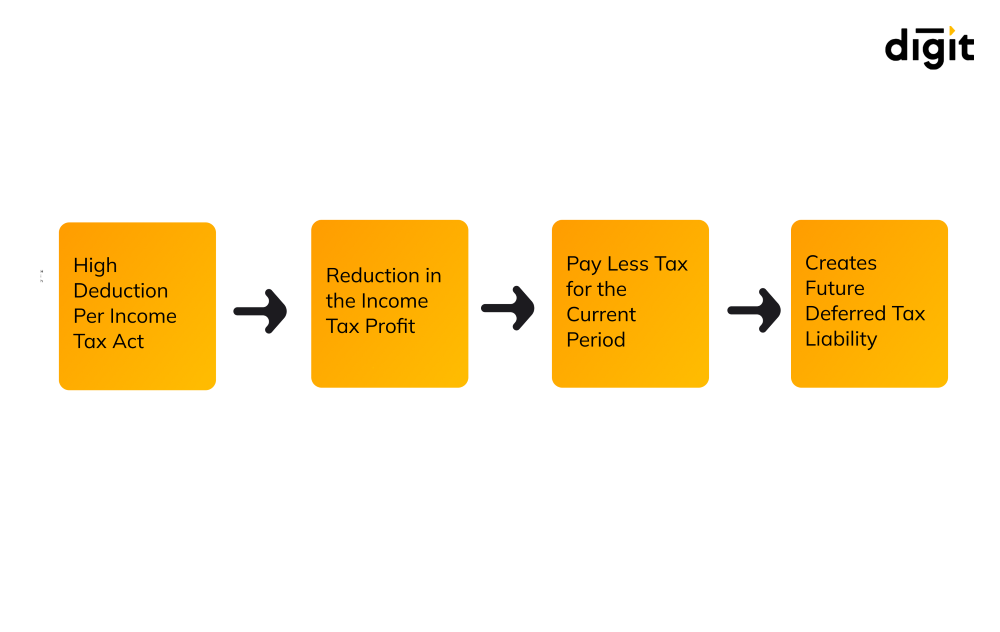

What Is Deferred Tax Liability?

Deferred Tax Liability meaning is simple as it deals with the tax dues of a company. It occurs in the balance sheet when a company has underpaid the tax liabilities and promises to pay in future.

Individuals should know that liability doesn’t indicate that a company hasn’t paid even a single amount against tax. Instead, the company promises to pay the tax at a different period.

In a balance sheet, deferred tax shows that the taxable income is less than the revenues mentioned in a company's financial statement.

The conditions that can lead to a Deferred Tax Liability situation are-

When a company drives their proceeds to showcase the shareholders.

Companies practising dual accounting. They keep an extra copy of financial statements for personal use or endow the same to tax experts.

Enterprises try to reduce their tax amount by pushing their current profits into the future. They use the extra income for business operations rather than paying tax. Their target is to boost the profits.

Let’s take simple examples to understand deferred tax meaning by segregating assets and liabilities.

Example of Deferred Tax Assets and Liabilities

The following Deferred Tax Asset example explains the concept in detail.

For instance, a mobile manufacturing company expects that the warranty period claimants will be only 2%. If the payable tax for a financial year is ₹1 lakh, then the balance sheet and income tax statements will show the following indications.

This example clearly shows the tax difference of ₹400.

|

Balance Sheet Factors |

Amount |

|

Income/Revenue |

₹1,00,000 |

|

Taxable income |

₹98,000 |

|

Warranty claim expenses |

₹2000 |

|

Tax payable (at 20%) |

₹19,600 |

|

Balance Sheet Factors |

Amount |

|

Income/Revenue |

₹1,00,000 |

|

Taxable income |

₹1,00,000 |

|

Warranty claim expenses |

Nil |

|

Tax payable (at 20%) |

₹20,000 |

Illustration on the Calculation of Deferred Tax Asset And Deferred Tax Liability

This table explains the concept of Deferred Tax Asset And Deferred Tax Liability. Let’s assume that the illustration doesn’t have an opening balance for book and tax records.

|

Specifications |

Difference (Book-Tax) |

DTA/DTL |

|

Income |

₹2,00,000 (₹10,00,000-₹8,00,000) |

- |

|

Reduction |

₹1,00,000 (₹2,00,000-₹1,00,000) |

₹30,000 (30% of ₹1,00,000) |

|

Payable sales tax |

₹50,000 (₹50,000- ₹0) |

₹15,000 (30% of ₹50,000) |

|

Leave encashment |

₹1,00,000 (₹2,00,000- ₹1,00,000) |

₹30,000 (30% of ₹1,00,000) |

|

DTA/DTL (closing balance) |

- |

₹15,000 |

Here the payable tax will be -

= 30% of ₹8,00,000

= ₹2,40,000

If the deferred income is ₹15,000, then the net tax effect will be the difference.

= ₹2,40,000- ₹15,000= ₹2,25,000.

Individuals can also use this example to understand the Deferred Tax Liability calculation.

Let’s check the impact of DTA and DTL on tax holidays in the balance sheet.

How Does DTA/ DTL Affect Tax Holidays?

Individuals should know that the government offers tax holidays to public and private organization employees.

This helps in reducing the liabilities or eliminating them. In addition, many companies use the tax reduction to establish a free trade zone.

The Government usually discards taxes for an interim period to boost consumption and production of certain items. However, this factor is subject to various conditions.

Individuals should know that deferred income tax from the timing difference can cause setbacks during the tax holidays. Hence, it should not be implemented during an enterprise’s tax holiday period.

Instead, the deferred tax related to the differences in time should be calculated in the origin years.

Let’s check the effect of DTA and other factors that affect the MAT.

What Is the Effect of Deferred Tax Asset And Deferred Tax Liability on MAT?

Individuals should know that the company should pay the MAT or Minimum Alternate Tax when the tax payable is less than the tax computed. This difference is at 18.5% of a profit book.

Section 115JB of the Income Tax Act levies the MAT calculated as per an entity’s book profit.

Individuals should know that a company’s book profit can boost by the following factors-

- Uncertain liabilities provisions

- Amount carried to a reserve

- DT provisions

- Income payment.

However, this can decrease drastically when –

- Depreciation debited to profit and loss sheet

- DT credit to profit and loss sheet

- Unabsorbed depreciation

- Amount is withdrawn from savings.

This is the necessary information on deferred tax and the factors impacting it. In addition, individuals can consult a professional to understand the differences between assets and liabilities of their company.

This will help them decrease their tax liabilities efficiently and gain the deferred income tax benefit.